5:00

4

min at reading ▪

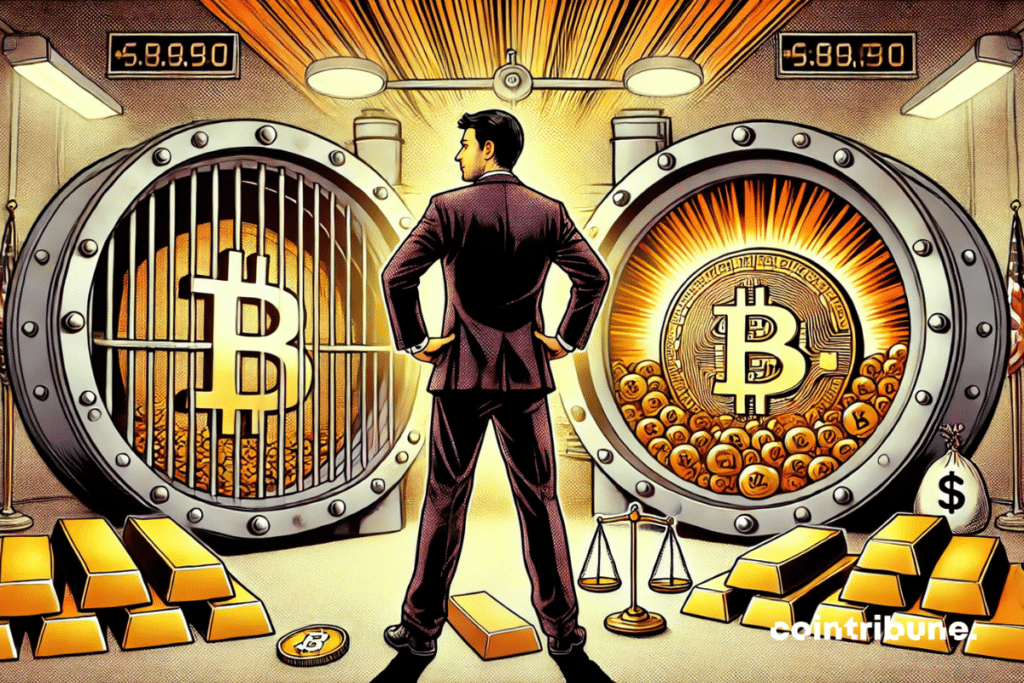

While World Central Banks have reached an endless money press at the plant, François Asselineau, President of UPR, offers a radical move: Integrates 5 to 10 % of Bitcoins into Banque de France. The idea that shakes traditional economic security and questioning our relationship to sovereignty. This proposal, irreconcilable observation: Bitcoin is not a simple cryptocurrency, but a tool of resistance in the face of financial freedoms.

Strategic shield against drift of traditional currencies

Reserve of immune value to central banks? Bitcoins, with a ceiling set to 21 million units, embody this unprecedented digital rarity.

Unlike gold, whose real reserves remain opaque (who knows what Fort Knox is hiding?), Is every bitcoin traceable, verifiable and impossible to duplicate. Revolutionary transparency.

Asselineau underlines the paradox: France holds 2,436 tons of gold, but remains vulnerable to monetary crisis of trust.

By allocating 5 to 10 % of his bitcoin reserves, he would diversify his financial arsenal. Courage, but a calculated bet.

Recall that Salvador, a pioneer of this matter, has already transformed part of his public cash desk into bitcoins and resisted the IMF. Result? Economy less dependent on the dollar and the influx of innovative capital.

Mining, often criticized for its energetic impact, becomes a geopolitical benefit here. By appreciating excess energy (as in Finland, where the data centers of thermal cities) France could transform the environmental restriction into an industrial lever. The idea that shouts dogmas: What if Bitcoin was not a problem, but a part of the solution?

Digital Euro vs Bitcoin: Invisible fight against financial freedom

Digital euro hides an impressive trap for the promises of modernity: complete supervision. Programmable, endless trackable, opens the door to Chinese social credit.

Marvin Scarella, an expert invited by the UPR, sums up: “With a digital euro, your wallet becomes dependent. Bitcoin remains safe in personal. »»

The difference is essential. While the ECB plans to limit the use of cash (already limited to EUR 1,000 in France), Bitcoin allows transactions without permission, bypass sanctions and checks.

A lively tool for countries embargo, such as Venezuela or Iran, but also for average citizens. Did you know that 12 % of Frenchmen already hold cryptocurrencies? Silent background blade, ignored by elites.

In this context, Asselineau’s proposal is not only economic: it is extremely political. The constitutionalization of cash and the acceptance of Bitcoins refuses to control banks over our lives.

Asselineau does not offer a speculative striker, but a strategy of sovereignty. The integration of bitcoins into French reserves expects the collapse of trust currencies and at the same time protects individual freedoms, although it has also abandoned key support against gold.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Evariste, fascinated by Bitcoin since 2017, has not stopped documenting on this topic. If his first interest focused on trading, he now tries to actively understand all cryptocurrency progress. As an editor, he tries to permanently provide high quality work that reflects the condition of the sector as a whole.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.